Multi-asset, multi-broker

CQG provides solutions for participants in global commodity, capital, foreign exchange, crypto currency and derivative markets. On a single platform you can monitor, trade and manage positions across the globe.

Comprehensive coverage

CQG connects to over 85 global market data sources, 45 tradable exchanges and 139 broker environments. Through our high-capacity Internet data feed, traders have access to a wide range of market quotations that leads to top shelf graphics, analysis, and execution.

Network speed

For speed of market data delivery and order execution, we use redundant networks designed to ensure that a real-time data stream flows to your platform instantly whenever an exchange records a trade.

CQG Market Data

What's New

Exchange connections

Custom Price Publishing

Solutions by Firm

Agricultural Commodities

The Original Futures Markets

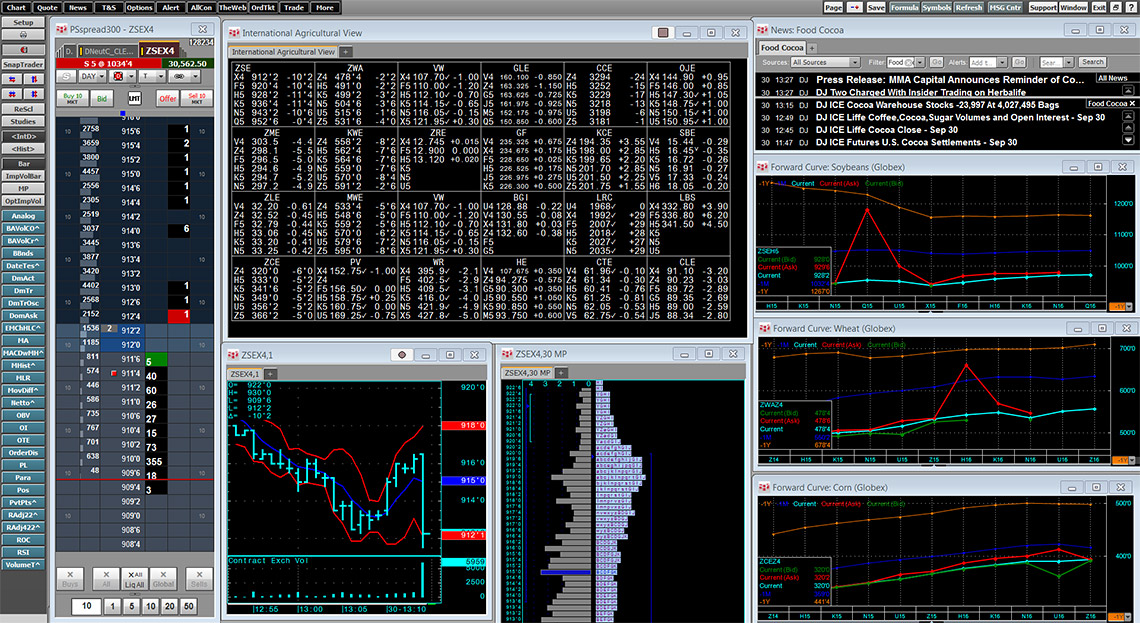

Traders in the agricultural markets use CQG for market data (many agricultural products have nearly 50 years of historical data), legendary analytics, and trade routing to futures exchanges around the world.

Analyzing and Trading Ag Products

We offer industry-leading charting and analytical tools for agricultural traders. Make your day-to-day workflow much more efficient by using CQG to:

- Track markets using numerous chart styles, including our exclusive TFlow® charts and forward curves.

- Create custom spread formulas for tracking calendar, butterfly, strip, and crush spreads as well as other spread relationships.

- Appraise the trend of agricultural markets using over one hundred standard and custom technical studies.

- Monitor correlations between markets to determine which markets are affecting agricultural price.

- Perform sophisticated analysis using our powerful trade system designer with backtesting, optimizer, and Signal Evaluator, which also allow you to scan markets for triggered conditions.

- Analyze options strategies on agricultural futures.

Agricultural Spreading and Aggregation

Term structure traders can spread markets using CQG's co-located servers. Compared to traders using client-side solutions, traders using the CQG Spreader have a tremendous advantage. You attain premium placement in the order queues for the working legs of spreads because the CQG Integrated Client trade routing interfaces connect to the exchange co-located CQG Spreader Core. Orders are configured on the CQG Integrated Client and then the servers use proprietary algorithms to manage the working legs of the order. Order modifications and execution of second legs occur in less than a millisecond due to the close proximity of the CQG Spreader Core to the exchange servers.

Fixed Income

Trading for the Hedger and

Short-Term Trader

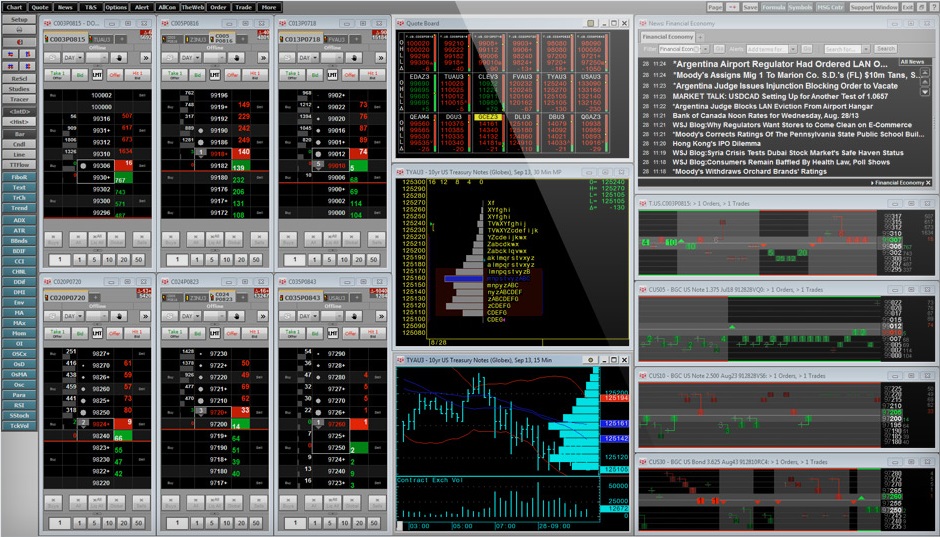

Fixed income traders look to us for market data and order routing to US cash treasuries platforms, Canadian cash bonds, and fixed income futures exchanges around the world. Fixed income yield curve traders can execute yield curve plays, calendar, butterfly, strips, and packs using our co-located servers.

Seamless Fixed Income Solution

Fixed income traders will find their workflow is a seamless process in CQG. We offer industry-leading trading tools, broad access to global market data, and advanced analytics all in one integrated platform. Our platform features:

- Hosted Direct Market Access to all major fixed income exchanges including ICAP's BrokerTec, Nasdaq Fixed Income, CME Group, and ICE Futures U.S.

- Market-depth fixed income trading using our DOMTrader®, Order Ticket, and Spreadsheet Trader interfaces, which are all customizable, enabling you to configure the interfaces the way you want.

- Instrument and Portfolio Monitors track instruments across multiple time frames and chart types with multiple studies and indicators in single spreadsheet views.

- Trading for US Treasuries, including futures, based on yield.

Server-Side Spreading and Aggregation

- CQG Spreader, developed exclusively for spread traders needing sophisticated order management and ultra-low-latency execution, allows traders to spread between multiple brokerage accounts. For example, a trader can spread US Treasuries against US Treasury futures even when they have different brokerage accounts for these instruments.

- Server-side aggregation is part of our suite of server-side order management tools. You can automatically trade similar instruments on two or more exchanges and manage where the trades get filled based on your preferences. These tools are extremely powerful when used with CQG Spreader. Unlike other vendors, we allow you to execute automated spreads where each leg of the spread is an aggregation of two or more markets.

Energy

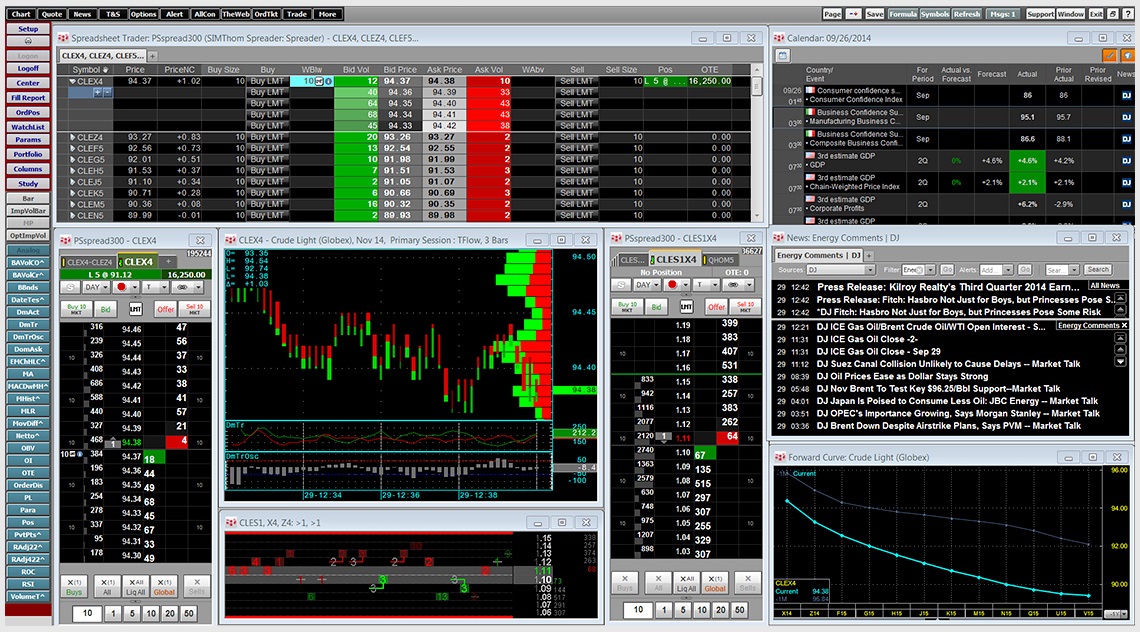

Legendary Charting, Analytics, and Fast Trading

Energy traders can access market data and order routing to futures exchanges around the world. Term structure curve traders can execute exchange traded or synthetic calendar, butterfly, strips, and spreads on products for both intra-exchange and inter-exchange spreads using CQG's co-located servers.

Analytics

Energy traders, brokers, and analysts are able to track and display market data using CQG's state-of-the-art graphics from over one hundred global sources. Access multiple chart styles, over one hundred standard and custom technical studies, custom spread formulas, correlation tracking, a custom formula and study builder, powerful trade system designer, options analysis, Portfolio and Instrument Monitors, and alerts.

Electronic Trading

Trading energy products is seamless on CQG. Each of CQG's order routing interfaces, DOMTrader®, Order Ticket, Order Desk, and Spreadsheet Trader, offer features specific to the professional energy traders' requirements. CQG supports both exchange-traded and synthetic energy spread orders.

Smart Tools

Create, trade, and manage multi-legged, intermarket, and intramarket spreads across accounts and asset classes. CQG aggregation allows you to trade similar instruments on multiple exchanges, thereby increasing the liquidity pool and the chance of being filled at the desired price. Our industry-leading tools exceed the professional trader's requirements.

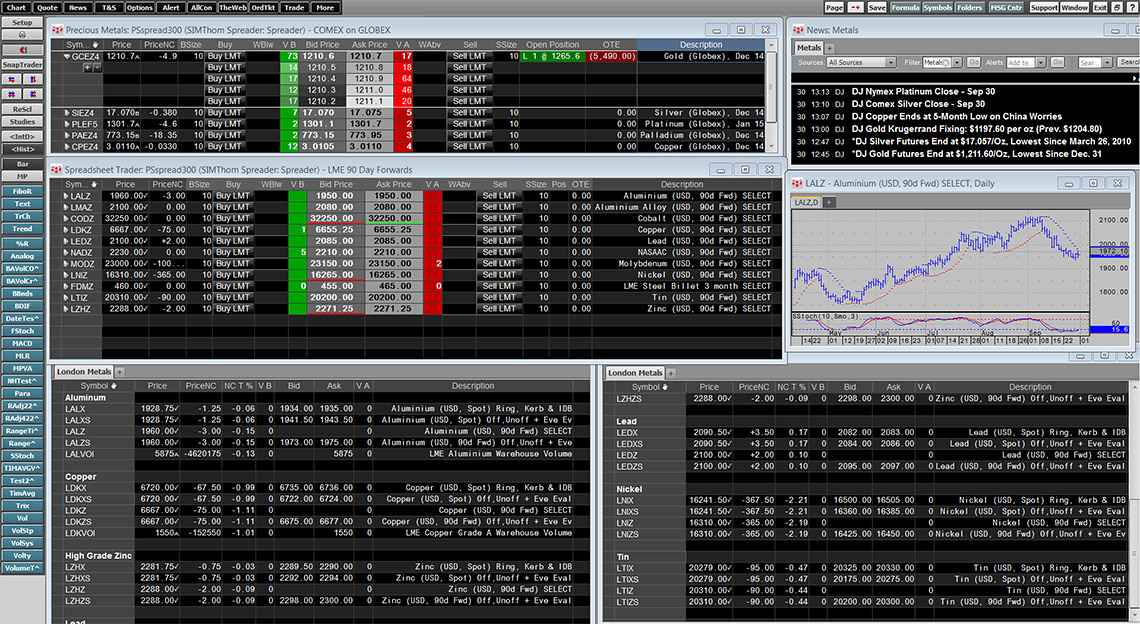

Metals

Precious and Industrial Metals Markets for Global Traders

Trade gold around the world through CQG: Chicago, Tokyo, Istanbul, and Sydney exchanges. Industrial metals traders use CQG to connect and trade on the London Metals exchange.

Analyzing and Trading Metals Products

Metals traders look to CQG for industry-leading charting and analytical tools. Make your work flow easier:

- Follow the markets using any of our different chart styles, including our exclusive TFlow® charts and forward curves.

- Use our QFormulas to create custom spread formulas for tracking calendar, butterfly, and strip spreads as well as other spread relationships.

- Monitor the technical market situations using over one hundred standard and custom technical studies.

- Gauge correlations between markets to determine which markets are affecting agricultural prices.

- Develop your own custom formulas and studies for market analysis.

- Design sophisticated analysis using our powerful trade system designer with backtesting, optimizer, and Signal Evaluator, which also allow you to scan markets for triggered conditions.

- Take advantage of CQG alerts to be notified of situations in the metals markets based on conditions, price, price crossing a pointer tool line, studies, time, news, and trading systems.

- View and trade a portfolio of metal markets and other products in a single view using Portfolio and Instrument Monitors.

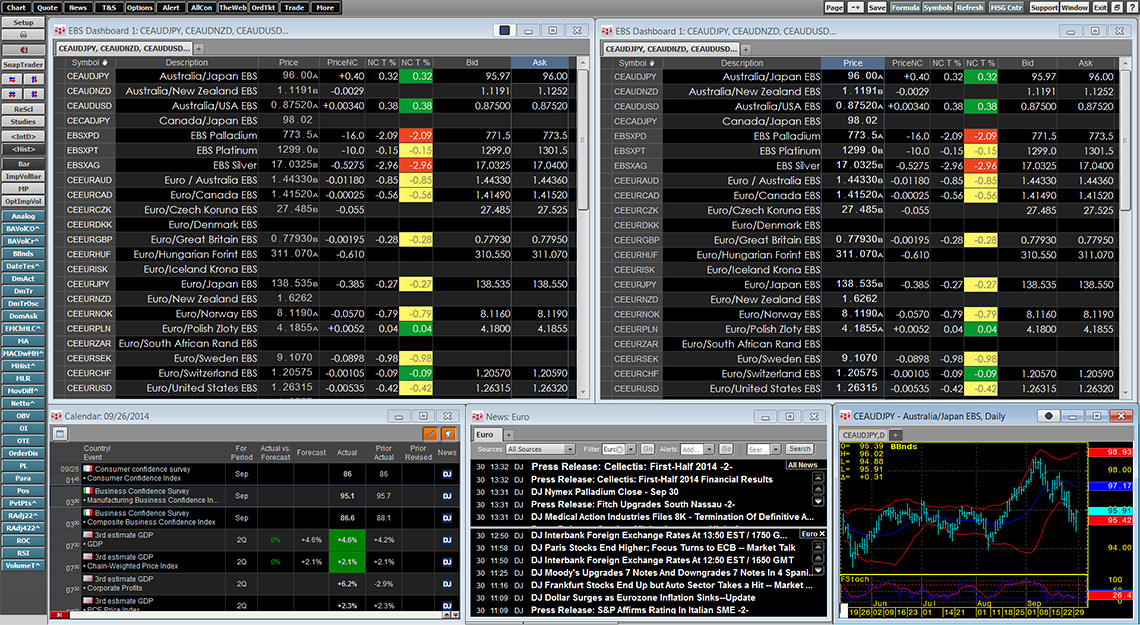

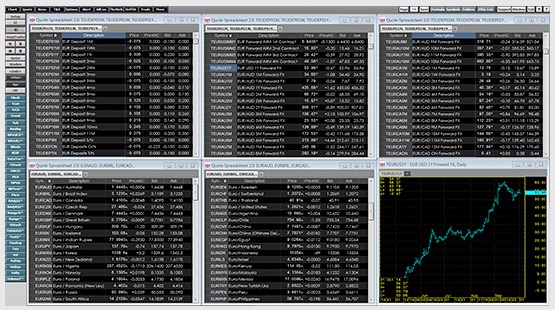

Foreign Exchange

Access the World's Largest Market through CQG

Market Data

- EBS Market Data, a state-of-the-art source of spot forex trading data.

- CQG Comprehensive FXTM, a data feed with FX spot indicative prices (bid/ask spreads) from banks worldwide, forwards, deposits, and precious metals data.

- CQG FX Index, a managed historical database of FX rates.

EBS Market Data on CQG

EBS is the premier source of liquidity in EUR, JPY, USD, and CHF spot rates with access to bid, ask, and last traded price data.

CQG Comprehensive FX

The Comprehensive data feed goes beyond bid/ask and last trade for FX spot to include forwards, deposits, and precious metals market data.

CQG FX Index

The CQG FX Index gives you index-type market data of the global forex rates.

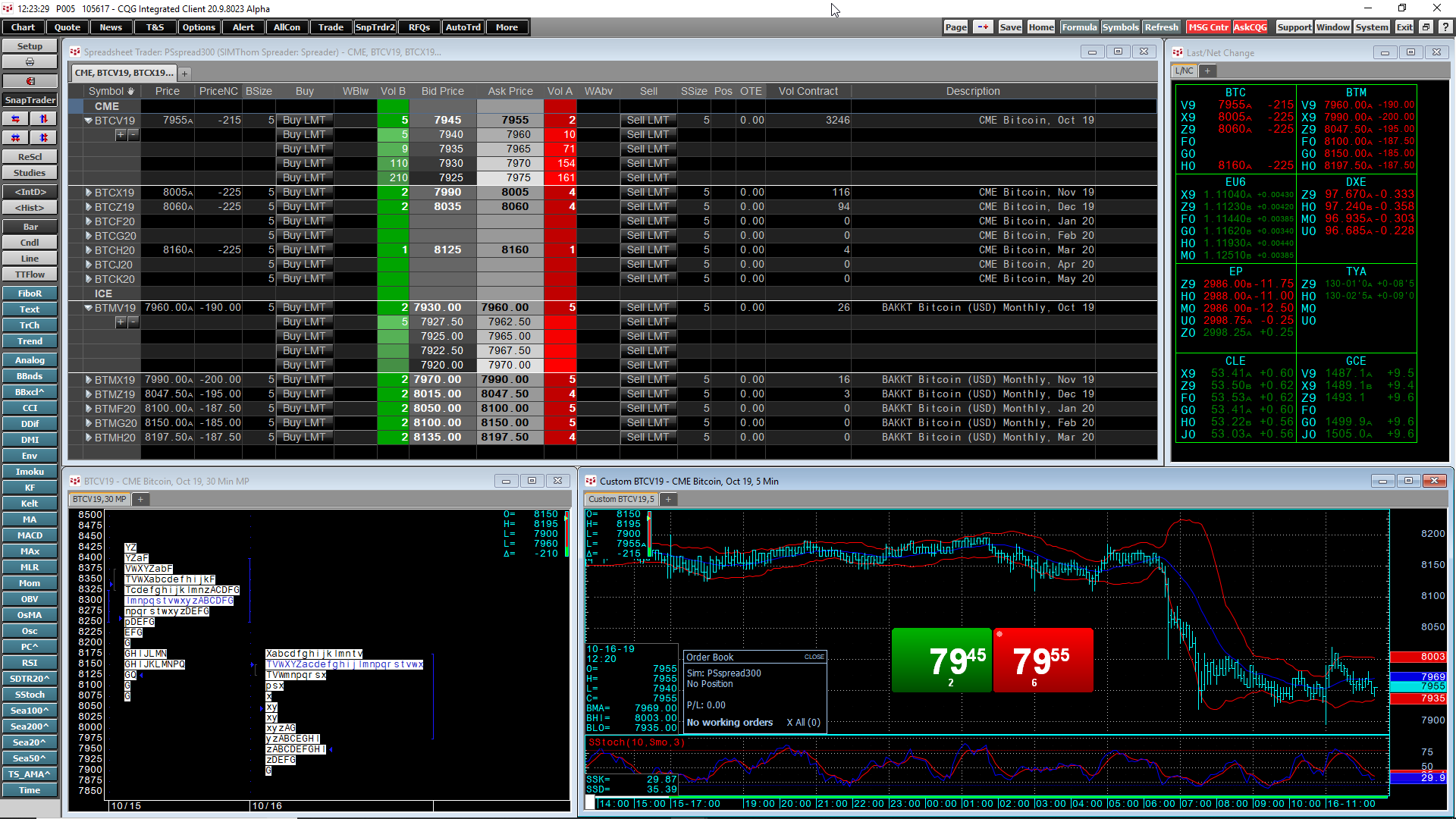

Cryptocurrencies

The new medium of exchange

Cryptocurrency traders can access market data, trade both cash and futures on various exchanges including the Chicago Mercantile Exchange (CME), Intercontinental Exchange (ICE), CBOE Futures Exchange (CFE), San Juan Mercantile Exchange, ErisX, and DVeX.

Analytics

Crypto traders, analysts, and brokers can leverage CQG's state-of-art charting and analytics to identify emerging trends for opportunities. Over twenty chart types and over one hundred standard and custom studies empowers the technical based trader. Design and implement your own custom studies, build and back test trading systems, perform options analysis. Traders can connect CQG to Microsoft Excel and deliver real-time data to Excel for modeling. The output of Excel's modeling can be brought back into CQG for charting and further analysis.

Electronic Trading

Seamless trading in crypto currency markets is standard for traders using CQG. Each of CQG's order routing interfaces, DOMTrader®, Order Ticket, Order Desk, and Spreadsheet Trader, offer features specific to the professional traders' requirements. CQG offers an AutoTrader that can access Excel model outputs for trading signals.

Server-Side Spreading and Aggregation

CQG Spreader offers sophisticated order management and ultra-low-latency execution allowing traders to arbitrage between markets. Server-side aggregation enables traders to automatically trade similar instruments on two or more exchanges and manage where the trades get filled based on preset preferences.

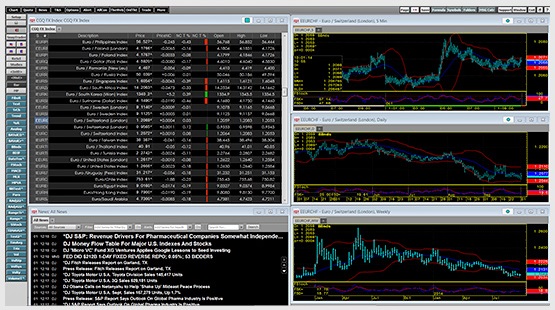

Multi-Asset: Equities

CQG is a sophisticated platform for monitoring, analyzing, and trading multiple asset classes including equities.

Take Stock, Weigh Options,

and See the Future(s)

Leverage CQG's hundreds of data sources and trade across multiple markets in one powerful platform. From Futures, Options, Fixed Income, to Equities and CFDs, FX and crypto currencies, CQG is continuing to partner with established partners and new liquidity providers to give customers a world of opportunities in the markets.

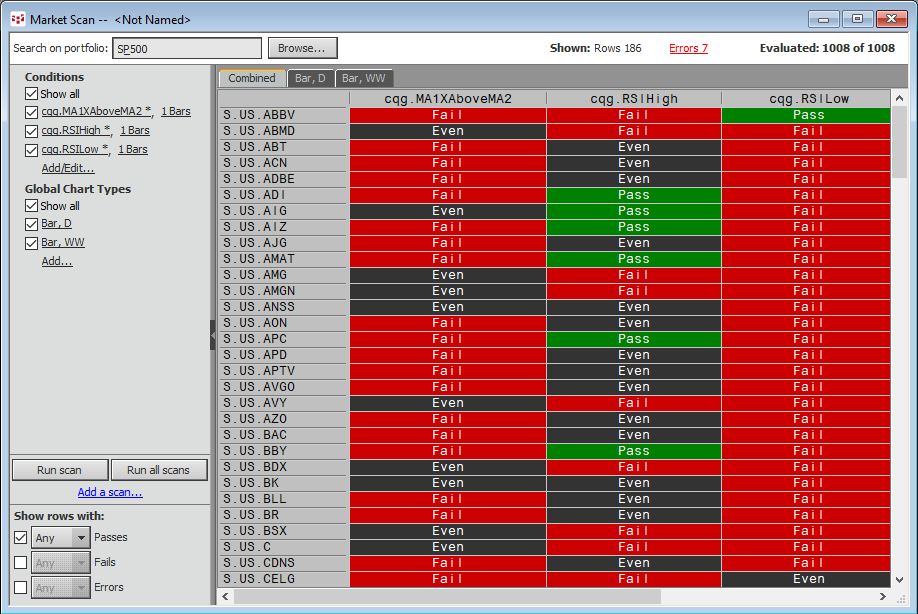

CQG's market scan can analyze a portfolio of stocks and identify which stocks are meeting your conditions. You can create any condition you want to use.

For example, this example is a scan of the stocks that are in the S&P 500 Index and the S&P 500 SPDR (Symbol: SPY) ETF looking for those stocks with rising moving averages and overbought or oversold conditions on two different time frames. This data can be exported to Microsoft Excel for further analysis.

CQG's Portfolio Monitor can provide you with an instant view of the stock market. This example lists the symbols in the NASDAQ 100 Index and the PowerShares QQQ Trust (Symbol: QQQ) ETF.

The portfolio is dynamically ranked by percent net change so you easily see today's top performers in the NASDAQ 100 Index. All of this data can be exported to Excel.

Sharpen Your View of FAANG

CQG offers twenty-six different chart types including overlay charts. This example is showing the FAANG stocks: Facebook (Symbol: FB), Amazon (Symbol: AMZN), Netflix (Symbol: NFLX) and Alphabet's Google (Symbol: GOOG). The chart is an overlay chart showing the intraday price action of all five stocks in a single chart.

Seamless Integration

All of CQG windows can be linked to each other. For example, you can link the Portfolio Monitor to a chart and to a trading interface. Selecting any symbol in the monitor will change the chart and trading interface to the same symbol.